Thankfully finding your operating income is fairly straightforward. By leaving these out of your calculations you can eliminate factors that differ from property to property, and obtain more accurate data for comparing potential rental investments on head-to-head basis. Then simply input your monthly rent and other income and any annual expenses into the above NOI calculator to find your net operating income.īecause mortgages vary between investments, your NOI calculation should not include your mortgage.

Net operating income formula accounting software#

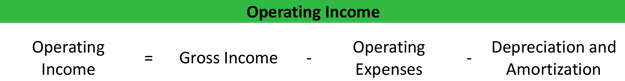

Related Read: Reporting and Accounting Tools: Best Accounting Software for Landlords What is NOI Used for?Ĭalculating NOI will allow you to find how much money a property earns after accounting for all of the Operating Expenses. Our favorites include Doorloop, Landlord Studio, and Stessa Popular online rent collection tools such as Availand PayRent make it easy for landlords to track income as well. This can be done using spreadsheets, though we believe that using property management software makes this task so much easier and more accurate. In order to effectively calculate your property’s profitability, investors must keep detailed records and carefully track all income and expenses. However, as many landlords know, these components entail several additional factors. Net Operating Income = Gross Operating Income – Operating Expenses Our partners at Doorloop provide a simple definition: “After deducting essential operational expenses, NOI evaluates the profits and revenues of an investment in a real estate property.” Net Operating Income Calculation Many real estate investors are confused when it comes to the NOI meaning, often wondering “what does NOI stand for?”. maintenance, insurance, property taxes, utilities, etc). Therefore, a NOI calculator comes in handy for landlords who want to quickly know whether a real estate investment is worth looking into more. Essentially, it calculates the revenue generated from a property after subtracting your Operating Expenses (e.g. In short, Net Operating Income is an important factor in determining the profitability of a potential real estate investment.

What is Net Operating Income in Real Estate? Collect Rent, Earn $150 $300 for Landlord Banking

0 kommentar(er)

0 kommentar(er)