How third parties can protect against the risks of non-arm’s length transactions, and.Examples of when non-arm’s length transactions are either subject to increased scrutiny, special treatment or disqualification.What types of relationships may cause an entity to characterize the transaction as non-arm’s length.

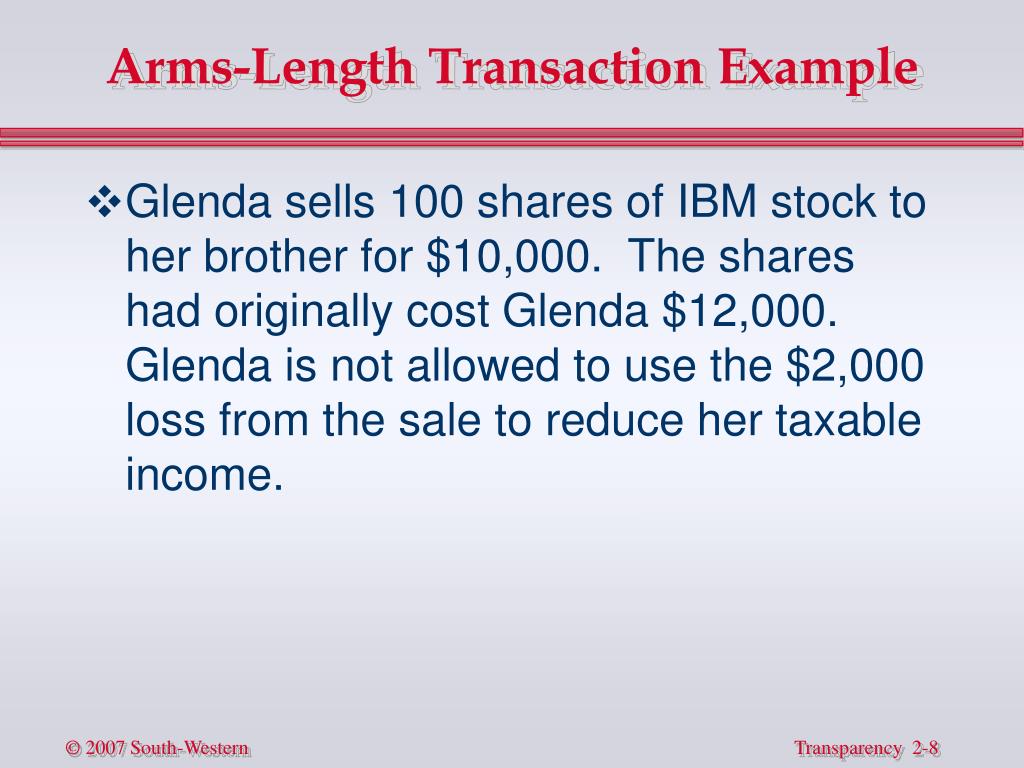

What makes a transaction arm’s length, and why people care.These are two examples of non-arm’s length transactions, and a good illustration of why it’s important to understand the concept of an arm’s length transaction. But then later you get a call from your accountant explaining that the gain you made on the sale would be treated as ordinary income instead of a capital gain, and your ability to use a like-kind exchange would be restricted.Īgain, might have been nice to know that agreements between certain related parties could have significant tax implications. Suppose you own several rental properties and then decide to sell them to your son at a market rate. Might have been nice to know the seller and buyer were related and this was not an arm’s length transaction. Now you’ve foreclosed on an office that is worth less than the outstanding loan amount. Months later, the borrower defaults and the brothers disappear. It turns out the brothers conspired to transfer the office property at an inflated price. However, after closing the loan, you discover that the LLC’s managing member is the brother of the seller. Suppose you’re the lender to an LLC formed to acquire an office building. To see why, consider the following scenario. Arms length transactions are important to understand in commercial real estate, particularly for lenders.

0 kommentar(er)

0 kommentar(er)